March 28, 2019 | Mason Roberts

When owning a small business, cash flow is the capital you have coming in and out. That is the simplest way to put it, while there are still many factors involved.

Your small business cash flow can be a way to measure your success. The more cash that is coming in, the more you are achieving. But, with this in mind, you must remember what payments you will be receiving and how to dish out the cash you owe.

It really pays to consider all the fees and bills as part of your cash flow, and it can cost you a lot to neglect them. This could throw off your whole financial outlook and your earnings to expense ratio, which could, in turn, impact the success of your business.

The Importance of Small Business Cash Flow

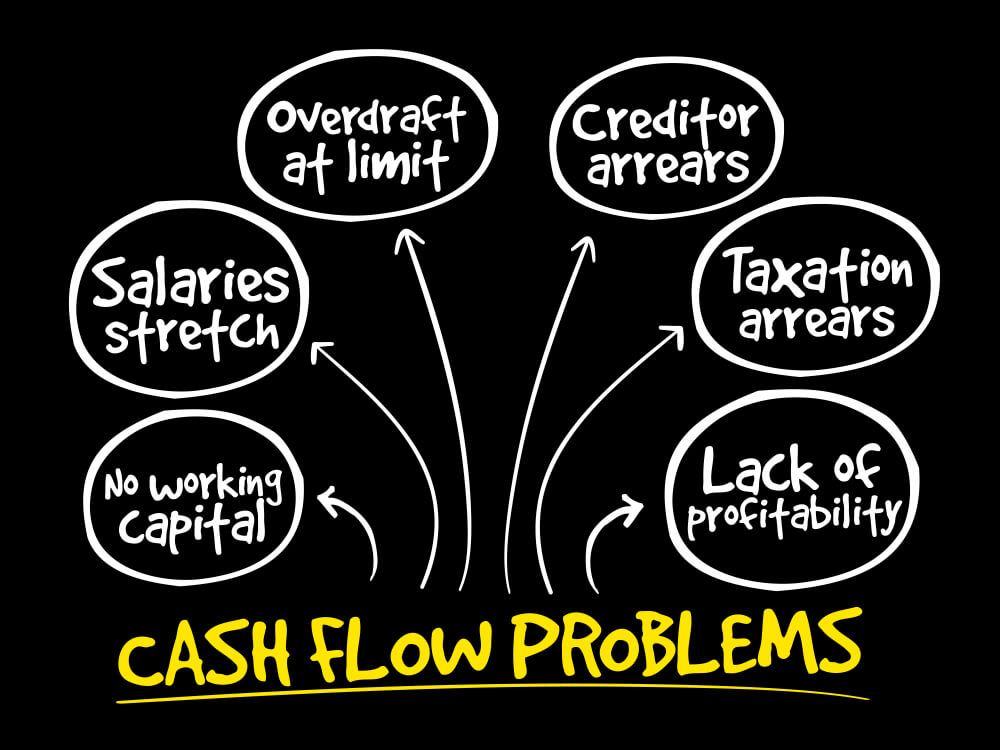

Avoiding cashing flow problems can be a grueling task, and can happen quite unexpectedly. There are several ways to be aware of the potential cash flow issues you may face in the future. Here are some of top ways to effectively manage your small business cash flow.

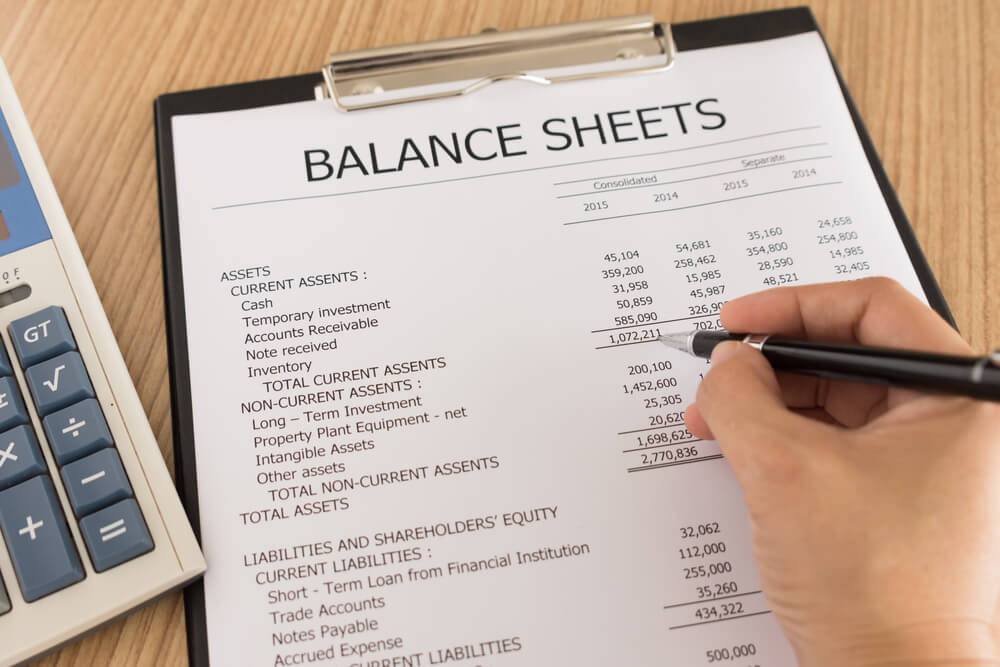

1. Track The Cash Correctly

Forecast your cash flow accurately. And there's a simple way to do this. Just jot down the prices that cash you are spending and the timing of which you are spending. Now, do this for the money coming in. keep track of the capital being earned. This is a good idea because it's something you can look back on for reference. If your small business is relatively the same in all aspects as it was the previous year, then you should be able to look back in your finances to predict an estimate of cash to be earned and to be spent.

When calculating your finances, consider the costs of different aspects of your business, too. You will have production costs, service costs, and salaries to pay. There may also be more, depending on the type of business you are running, the type of project you are completing, and the demands of your growing business.

2. Compare All Your Forecasts to Reality

While it is a great idea to look back at previously forecasted finances, it can still be different than you expect, even if your business has stayed more or less the same. Comparing your prices and cash flow to the current economy and figure out how your prices may have changed over time accordingly. Check back into the stats of prices monthly, make sure everything is as it should be. This will give you an accurate amount of cash you will have in hand, in savings, and to be spent within the length of a week, month, or even year.

3. Have Multiple Backup Plans

In the face of small business cash flow, there are many obstacles that can come your way. It is not a good idea to only have one plan to depend on, especially in a corporate world. You have to have a backup, and then a backup plan for your backup plan, and so on. It is the only way to ensure that you can find your way out of any situation with a little hard work. Look at your finances and imagine any possible negative thing that can happen, and try and find a solution to each. Don't be left in the dark when it comes to furthering the cash flow of your own small business.

4. Invoice Your Customers

Getting paid and customers receiving invoices go hand in hand. Once customers receive their invoices, you should expect payments sooner rather than later. And that can help you project your earnings more reliably. Many small businesses look at invoice as if they are tedious tasks that don't do much for their bottom line, but that is simply not true.

They are very simple, easy ways to make sure your customers make on-time payments more frequently. When it comes to invoicing customers, make sure all the necessary information they will need to fulfill it is included, such as what they owe, how to pay, and when their payment is due. Some of your customers may have very busy, hectic lives, and may forget to follow through on some things, invoices included. Help them (and yourself) out by sending a complete and accurate invoice.

5. Convenient Ways To Pay

Following sending out helpful invoices to your loyal customers, you should also make sure there is a quick and easy way to complete payments. There is nothing worse than the headache that comes along with trying to pay a fee when the system or platform is hard to navigate.

To ensure the most amount of customers you can get, offer them different types of payment methods. This can vary from paying online, in cash, in check form, credit, debit, or even through an app. Also, it may be a good idea to offer your customers the choice of splitting their payments over several months and have a payment plan set in place, especially if your product is rather expensive.

Offering different types of payment methods will persuade your customers to pay much faster, as their preferred method of payment will be offered to them. This is an all around good and important thing to make sure to keep your cash flow on track as a small business owner.

6. If Necessary, Take Out A Business Fund

Cash flow problems can happen to anyone. It's the circle of life in the corporate world. You can do everything right and still get stuck in a difficult situation. If you have done everything suggested and more, then it may be time to take out a business fund.

When hearing this, many business owners get wary, not wanting to owe a funder their borrowed cash plus interest, but there are many different funding options and ways to receive the capital you need. For example, you can choose between a traditional and a non-traditional way of funding. There are benefits and cons to each, so choose what is best for your small business accordingly.

How Small Non-Traditional Funding Can Boost Your Small Business Cash Flow

Often times, small business owners get caught up in the complexity of their small business finances. It is very easy to come face-to-face with cash flow problems when running your own small business.

When it comes to running your own small business, cash flow is an important aspect to the growth and progression of your company. It's essential to keep a steady course in which you are receiving and spending your earned capital.

If you've been turned down for traditional funding before, there are lost of alternative funding options out there. Merchant cash advances or jumbo funding that can help you meet your mall business cash flow needs.

Reaching out for help in the right moment could be the difference between your company folding under the weight of its own debt and flourishing into the success you always knew it could be. Take a chance on yourself and give yourself the cash flow you need to take your small business to the next level today!